Crafting an Organic Foundation for the Future

How Strategic UX Increased Revenue & Transactions by Over 300% in 6 Months – While Also Boosting Rankings & Building a Robust Content Marketing Pipeline

The Challenge: When Success Creates Complexity

Ever wonder what happens when a bedroom startup grows into a major financial platform without hitting pause to reassess its user experience? We found out firsthand with CreditLoan.com, and spoiler alert: it involved turning a maze of financial products and mountains of data into a clear path to SEO success.

CreditLoan.com's story is one we've seen before: a passionate entrepreneur starts small, offering personal loans from a home office, and through determination and market insight, builds something substantial. But success came with a catch – years of adding new products and features had created a digital labyrinth that was increasingly difficult for users to navigate.

Think of it like adding rooms to a house without updating the floor plan. Sure, all the spaces are there, but good luck finding the kitchen at dinner time.

What needed fixing:

- Fragmented user journeys built up over decades of growth

- Over-reliance on expensive PPC advertising

- Aging content strategy unsuited for modern SEO

- Poor user engagement metrics hurting overall performance

Industry

Focus

Impact

Core Challenge

Our Approach: Rebuilding from the Inside Out

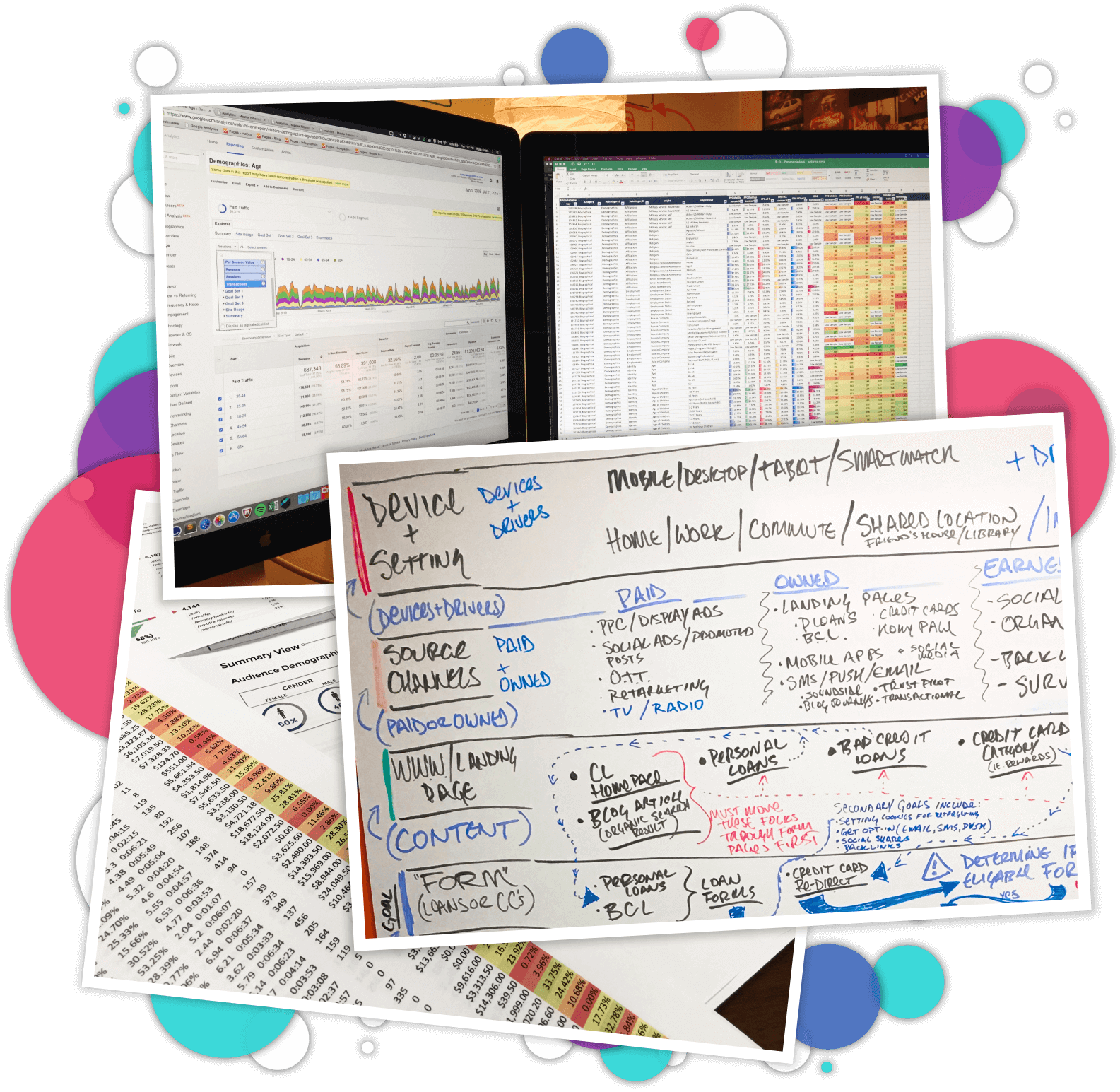

We love a good data treasure hunt, and CreditLoan.com had plenty of buried insights to uncover. We started by diving deep into years of user behavior data, competitive analysis, and performance metrics. But we didn't just collect data – we turned it into action.

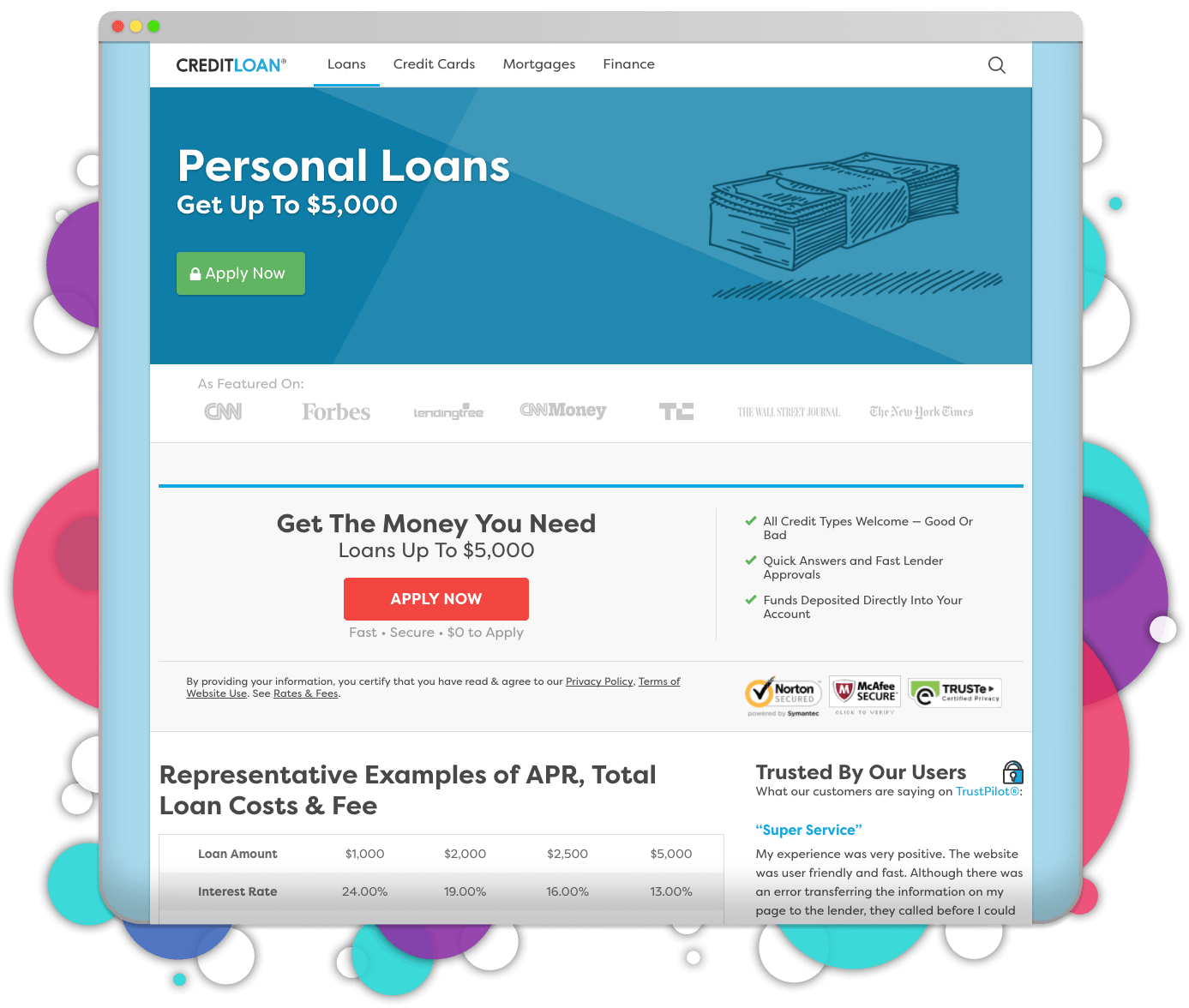

First up was tackling the content strategy. Remember when 500-word articles were considered "comprehensive"? Those days are gone, and we knew it. We assembled a dream team of financial writers and UX specialists to create truly valuable content that answered real user questions. We're talking 5,000+ word guides that didn't just scratch the surface – they dug deep into the topics users actually cared about.

Strategic Elements We Decide To Move Forward With:

- Auditing existing content and creating an orgainc focused content marketing plan

- Created comprehensive, long-form content targeting specific user needs

- Redesigned the experience to support different stages of the financial decision journey

- Implemented robust tracking, maintenance, and continuous testing/optimization plans to keep rankings high

- Developed an omnichannel engagement strategy to support user retention funnels

Diving into millions of data points across dozens of touchpoints and marketing channels was a must. You can't solve a problem if you don't understand the data behind that problem.

We needed to categorize & review each article for not only relevancy & accuracy, but to also map them to funnels & personas so we knew when to use them

The Secret Sauce: Understanding the Financial Customer Journey

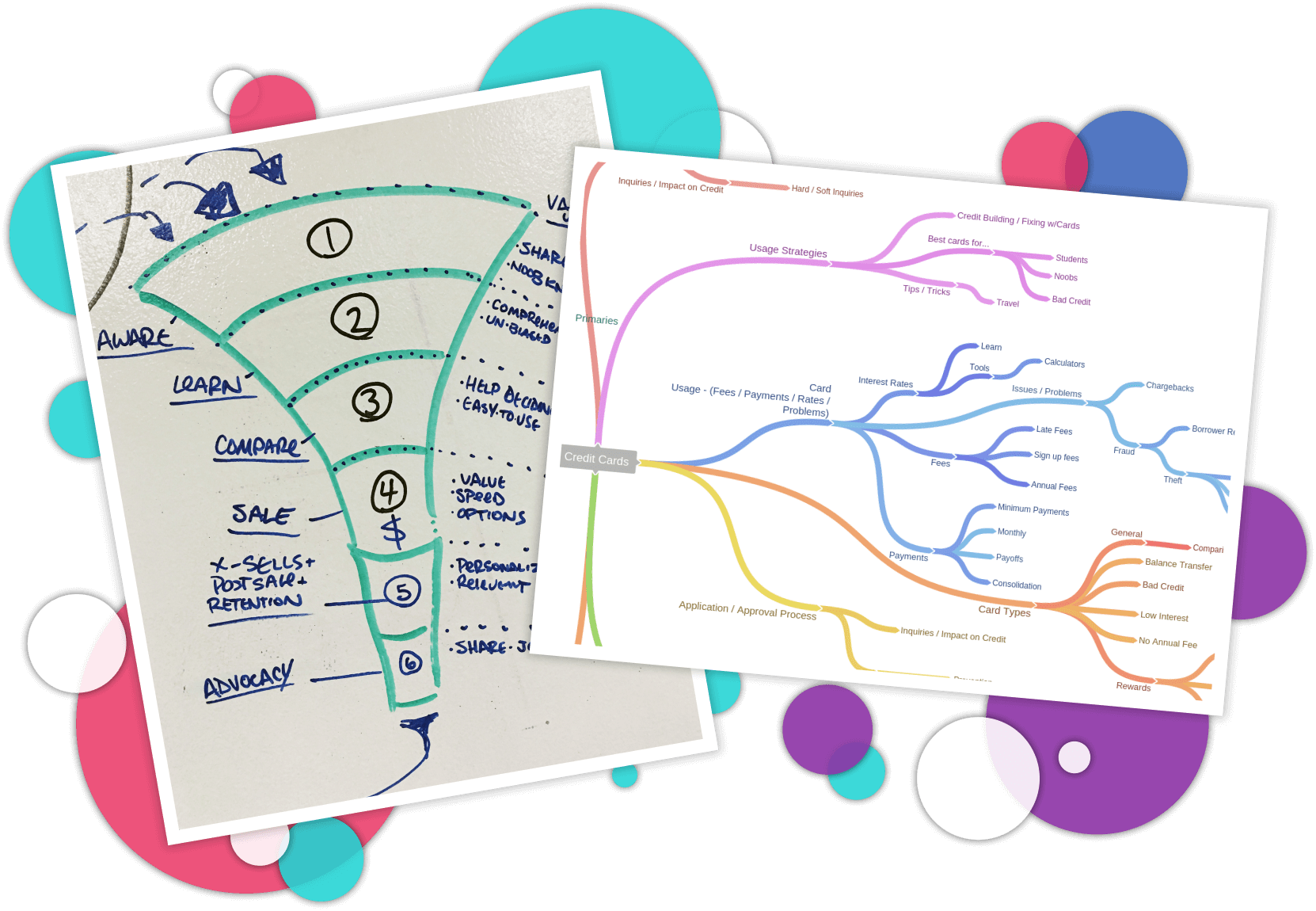

Major financial choices tap into deeper needs - security, opportunity, life changes. While people rarely wake up planning to get a loan, they do wake up thinking about buying their first home, launching a business, or handling unexpected expenses. The path to those goals often leads through multiple touchpoints, vendors, etc.

Through rigorous research, we mapped the authentic user journey - the actual steps, hesitations, and decision points that drive financial choices:

1. Initial research & education

Users spend weeks absorbing financial content across multiple sites before considering any specific product2. Product comparison & trust-building

Consumers will compare provider reviews, rates, and reputation signals across a few top choices3. Decision-making & application

Most users bounce between final vendors, options, and documentation requirements over 3-4 site visits4. Post-decision engagement & loyalty

After applying, users maintain high engagement through status checking and exploring related financial productsFor each stage, we crafted content and experiences that met users exactly where they were in their journey. Sometimes that meant providing in-depth educational content. Other times it meant showing social proof through testimonials or trust indicators like "As Featured In" logos from Forbes and The Wall Street Journal.

"The redesign didn't just modernize our platform – it fundamentally transformed how users interact with our products. The results speak for themselves: higher engagement, better conversion rates, and significantly improved customer satisfaction."

The Results: Numbers Tell A Great Story

Remember that treasure hunt we mentioned? Well, we struck gold. Within just six months, the transformation delivered results that exceeded even our optimistic projections. Dramatic ranking results right after launch showed just how crippled the site was with it's outdated SEO.

(Bounce & Exit Rates, Time on Page, Page Depth, etc.)

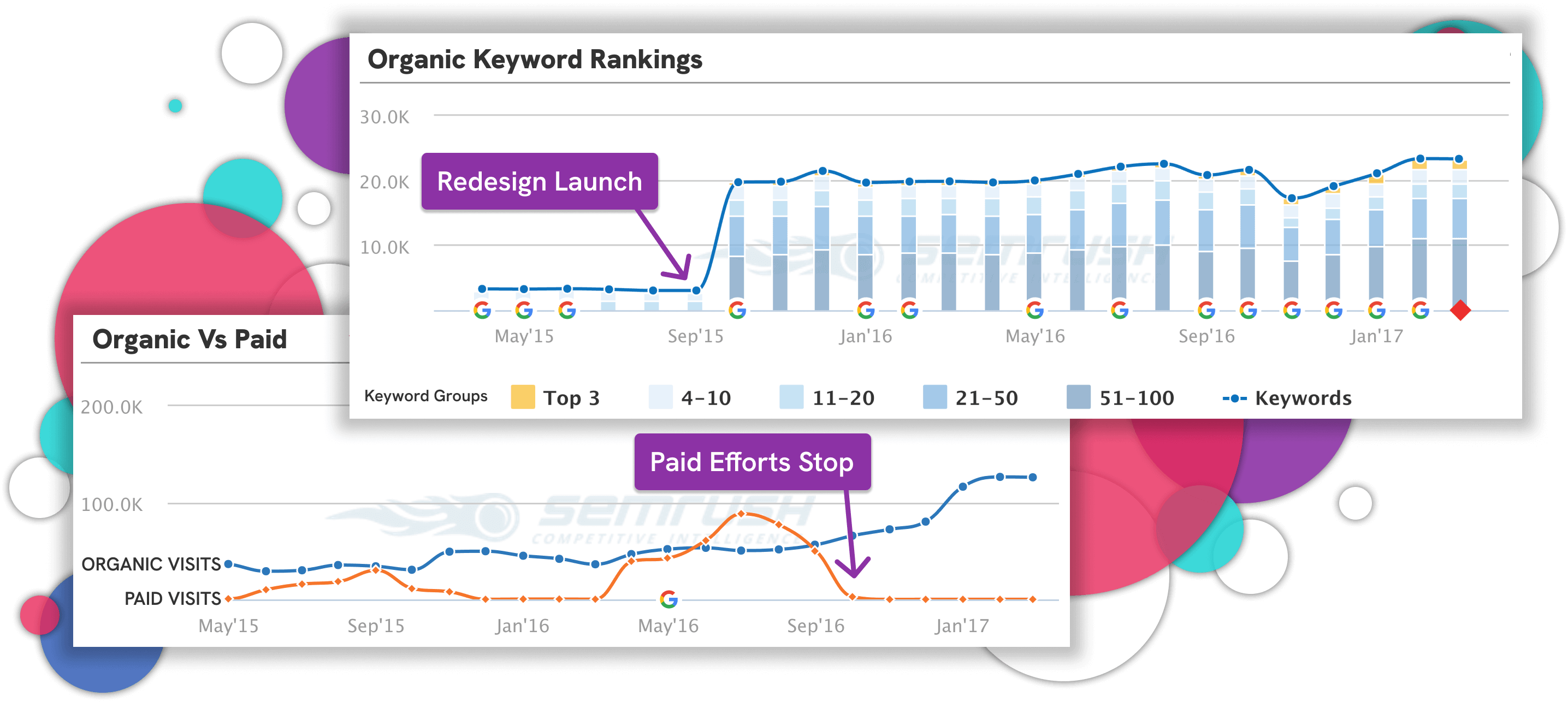

Almost instantly, Google re-ranked the site with nearly 20,000 targeted keywords and we made critical gains in first page & top 3 Groups due to our long-tail keyword focused content strategy

Organic Results Allowed Costly Paid Efforts to End Within a Year

Why keep “renting” customers with PPC? We replaced low quality, high cost Paid leads with higher quality organic consumers – nurtured with carefully planned funnels & content marketing

Why It Worked: Three Pillars of Great UX

Data-Driven Decisions

Quality Over Volume

Focus on the Full Journey

The Journey Continues

The initial transformation was just the beginning. We implemented ongoing optimization through:

- Regular user behavior analysis using tools like Hotjar and Full Story

- A/B and multivariate testing to continuously improve performance

- Omnichannel marketing integration including email, SMS, and browser notifications

- Targeted retargeting and lookalike audience campaigns

The best part? The system we built continues to evolve and improve, adapting to changing user needs and market conditions. It's not just a redesign – it's a living, breathing digital experience that gets better every day.