Breaking Through the Conversion Ceiling

How Strategic Landing Page Design Doubled Revenue While Mastering the Full Customer Journey

The Challenge: When Optimization Hits a Wall

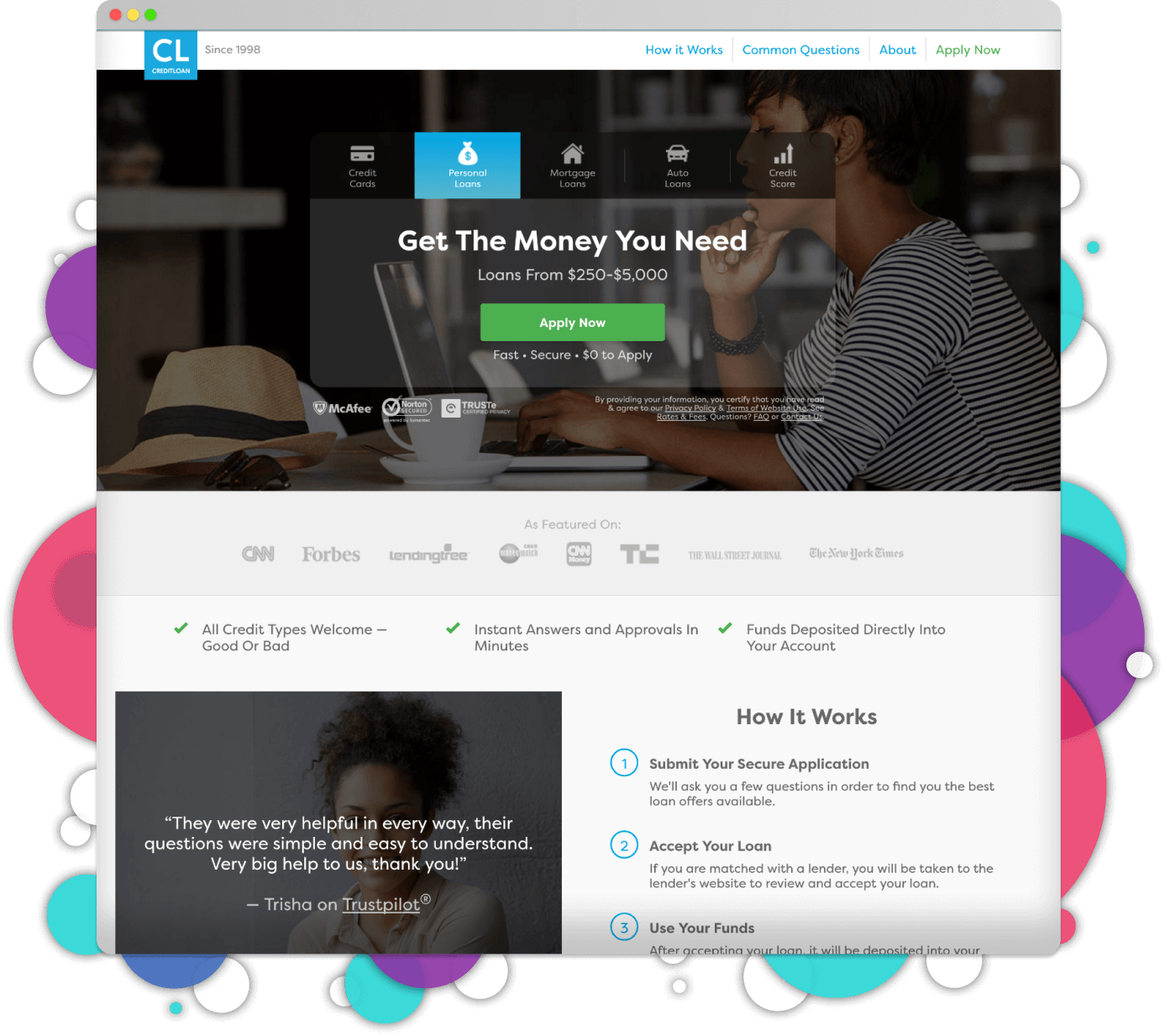

Here's the thing about optimization - even when you're using every tool in the toolbox, sometimes you hit a ceiling. That's exactly where CreditLoan.com found themselves with their paid landing pages. They weren't just running basic tests - they had multivariate testing humming alongside sophisticated testing frameworks, and analytics were tracking every user interaction imaginable. Heat maps? Check. User behavior analysis? You bet. Advanced goal monitoring? All day, every day.

But even with this powerhouse of optimization expertise and years of testing data, they needed something bigger than another round of tweaks. It was time to think bigger about what these landing pages could really become.

With daily ad spends soaring past $25,000 across platforms like Google Ads and Facebook, incremental improvements weren't enough. The landing pages were converting, but to unlock their full potential, the approach needed a complete rebuild from the ground up.

What needed fixing:

- Landing pages optimized for expensive late-stage buyers, missing huge opportunities earlier in the journey

- Conversion rates that had plateaued despite continuous testing

- Trust signals that weren't effectively bridging the confidence gap

- User experience that didn't align with the sophistication of their financial products

Industry

Focus

Impact

Challenge

Our Approach: Diving Deep into an Ocean of Data

When a client is spending $25,000+ daily on paid traffic and serving millions of visitors annually, even tiny improvements can have massive impacts. But this project wasn't about tiny improvements – it was about hunting for breakthroughs.

Our overall approach was to dive deep into the data, the user journey, and the content to find the hidden opportunities that could unlock the full potential of these landing pages.

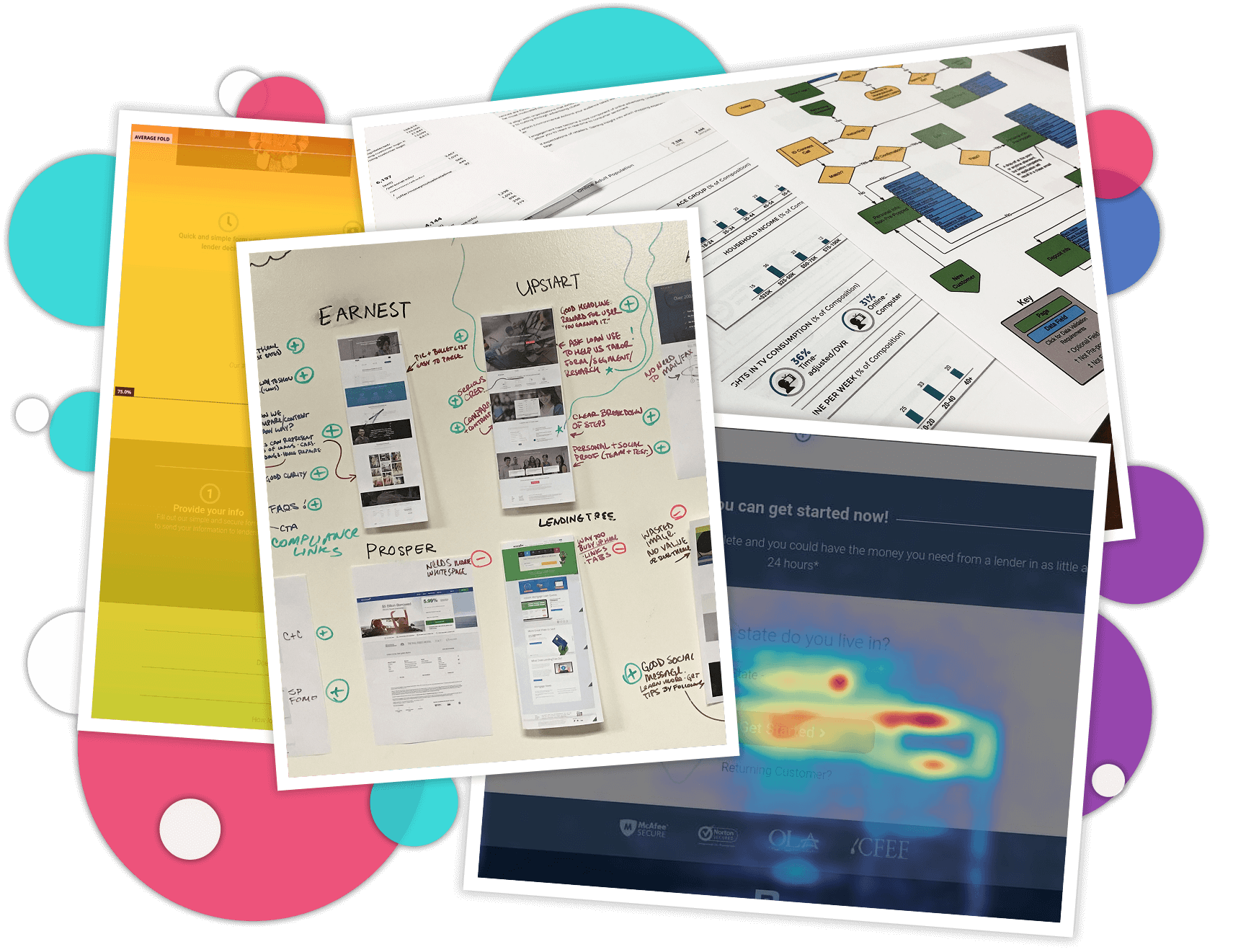

First, a comprehensive audit of their historical data revealed:

- Years of Google Analytics insights

- Heat, click, and scroll maps showing user behavior patterns

- Thousands of session recordings

- A/B and multivariate testing results spanning multiple years

But here's where the strategy shifted: instead of just looking at what users were doing, the focus turned to why they weren't converting. This shift in perspective unlocked crucial insights about gaps in the user journey.

The Secret Sauce: Understanding the Full Customer Journey

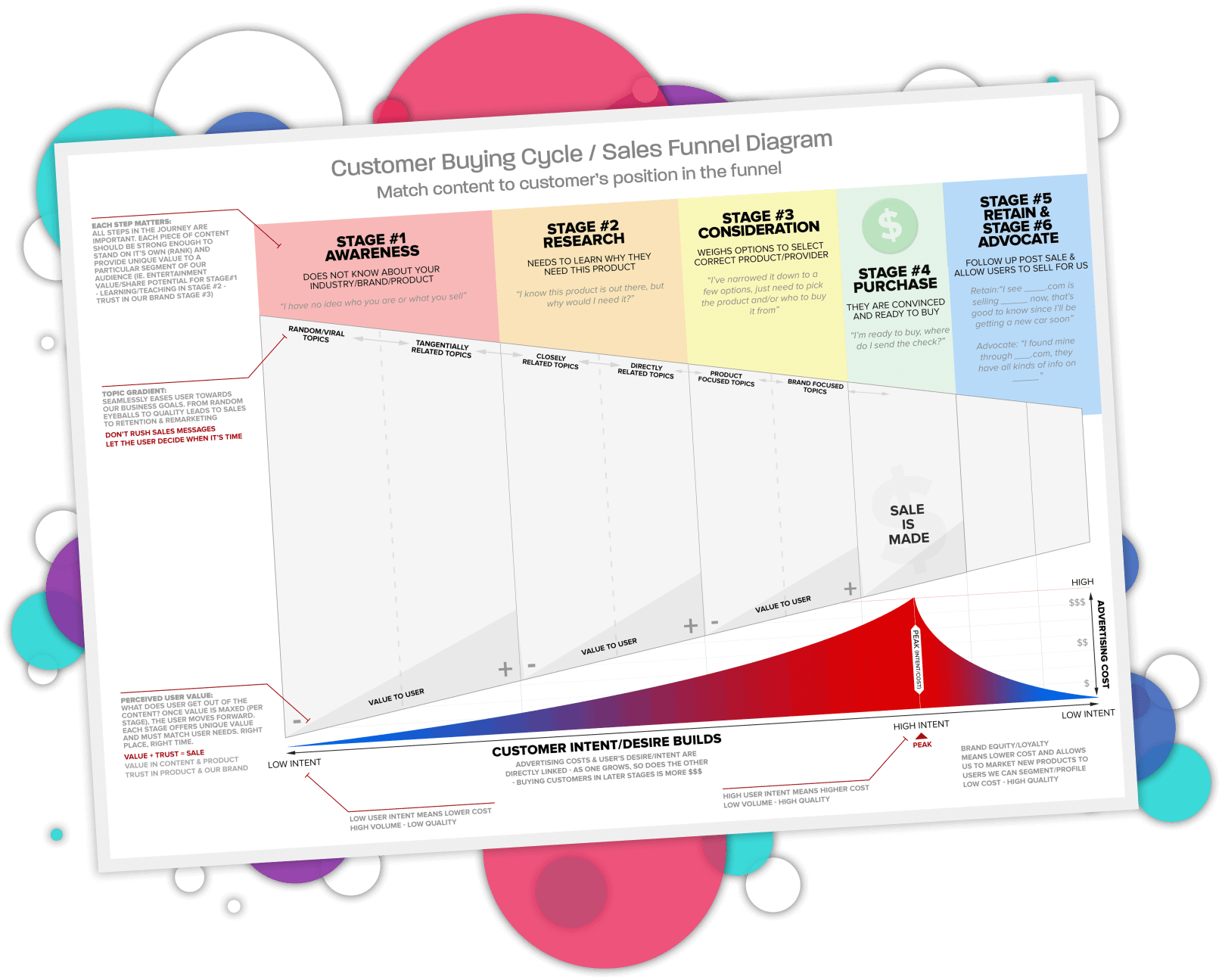

The biggest revelation? CreditLoan.com's landing pages were laser-focused on ready-to-buy customers, but that's not how most people shop for financial products. Here's what the analysis revealed about the real journey:

1. Early Stage: The Knowledge Seekers

Users who know they need financial help but aren't sure which product fits their needs. They're looking for guidance, not just a submit button.2. Middle Stage: The Comparison Shoppers

Visitors who understand their options but need confidence in their choice. They're weighing alternatives and looking for validation.3. Late Stage: The Ready-to-Apply Folks

The traditional focus – users who know exactly what they want and just need a smooth, secure sign up path to apply.The financial customer journey starts with Knowledge Seekers in the Awareness phase who know they need help but aren't sure which product fits their needs. These users want guidance and education before seeing application forms. They then become Comparison Shoppers who Research & Consider utheir options but need confidence in their choice as they evaluate alternatives. Once more confident, they'll be Ready-to-apply but still need assurance they can proceed safely – trust is critical. From there, retention becomes a critical peice of the funnel.

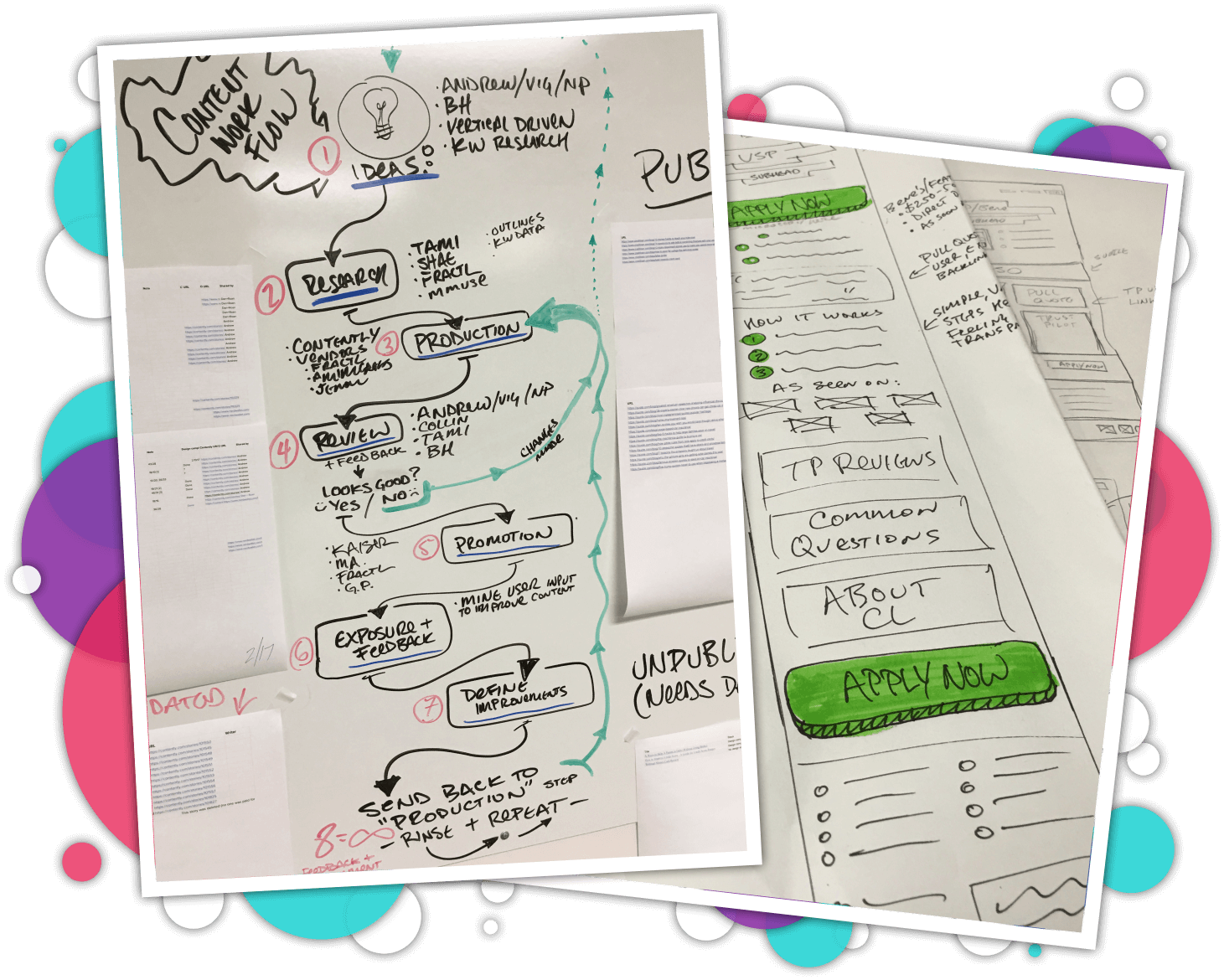

Implementation: Building for Every Stage

The transformation strategy focused on four core areas, each carefully designed to support different phases of the customer journey while maintaining strong conversion potential.

Knowledge Enhancement

The first pillar focused on education and clarity. Research showed that many visitors arrived with questions they needed answered before feeling confident about applying. A strategic "Common Questions" section addressed the most frequent concerns without pulling users away from the conversion path. Alongside this, intuitive product comparison tools and clear explainers gave users the information they needed while maintaining their momentum toward conversion.Trust Building

Trust signals formed the second crucial element. Financial decisions require confidence, so the team created a multi-layered approach to building credibility. Customer testimonials provided real-world validation, while a carefully curated social media feed showed active community engagement. This foundation was strengthened with third-party ratings and prestigious media credentials, including features in major financial publications. These elements worked together to create a strong sense of authority and reliability.Personalization at Scale

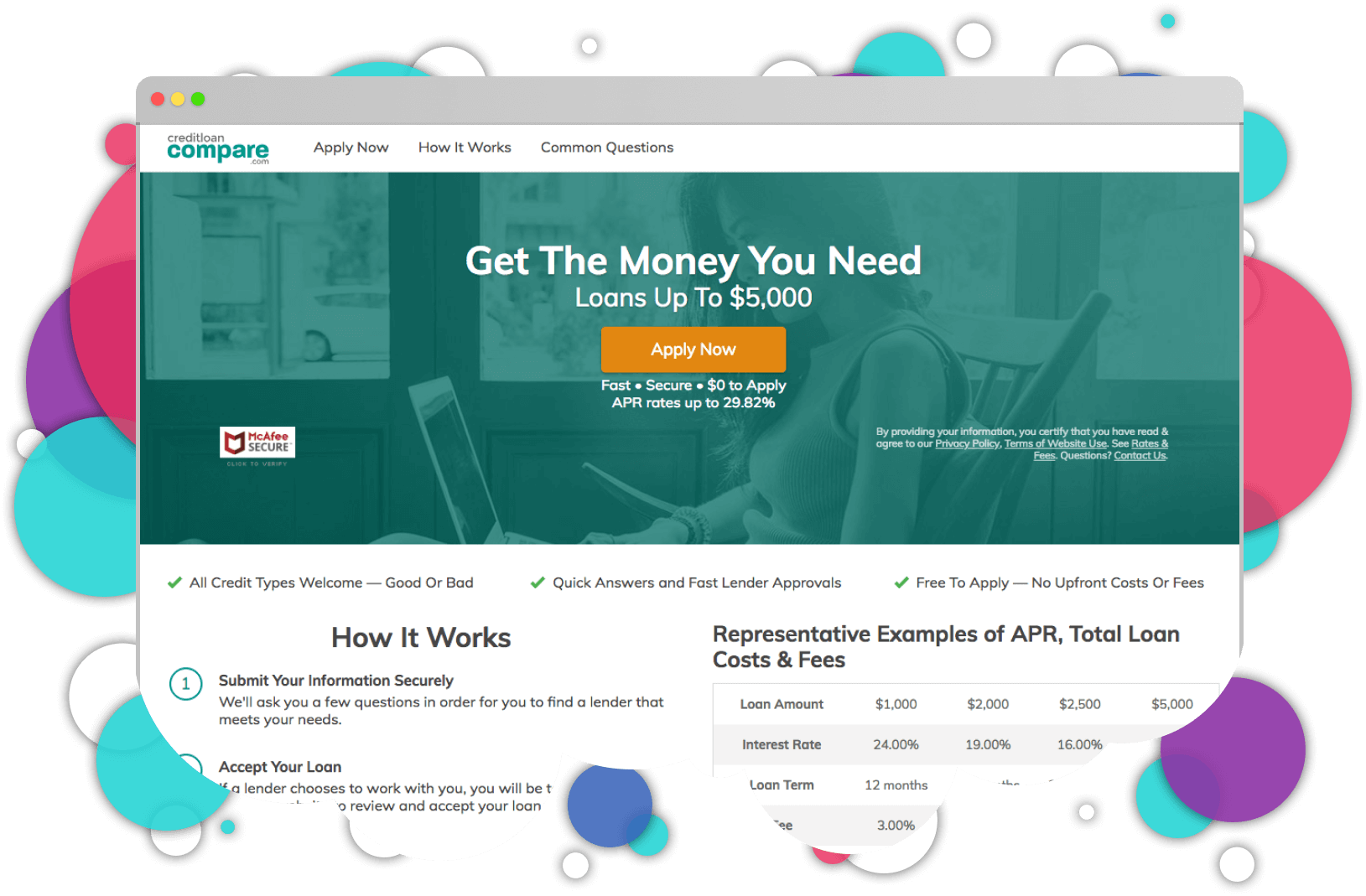

The team revolutionized their approach with dynamic landing pages that were easily adapted to different audiences. Rather than maintaining hundreds of pages for various loan options, debt consolidation, etc., the system automatically adjusted messaging, imagery, and content based on visitor intent. Personal loan seekers saw competitive rates and quick approval timelines, while auto loan prospects encountered content about trusted lender relationships. This highly flexible approach not only boosted conversion rates, but also transformed the marketing team's capabilities - allowing them to test and launch new campaigns in hours, not weeks.Visual & UX Optimization

The final piece of the transformation focused on the technical and visual experience. The design language was modernized while keeping conversion optimization at the forefront. This meant more than just aesthetic updates – font sizes were increased and contrast ratios enhanced to improve readability across all devices. Perhaps most importantly, the form fields were simplified, making them not only easier to complete but also more accurate in capturing user information. This improvement in data quality had downstream benefits for both user experience and conversion rates.Breaking Free from the "Rental" Trap

Here's where things get interesting – the strategy took an unexpected turn that transformed CreditLoan.com's entire approach to paid acquisition. Instead of just optimizing for immediate conversions, they tapped into something more powerful: their existing content marketing machine

Think about traditional paid advertising like renting an apartment. Every month, you're starting from zero, paying full price to reach the same customers again and again. Not exactly a recipe for sustainable growth, right? There had to be a better way.

The lightbulb moment came when the team realized they could leverage CreditLoan.com's robust organic content marketing infrastructure to transform their paid strategy. Instead of limiting themselves to high-intent (and highly competitive) keywords, they could now confidently bid on earlier-stage customers – because they had the tools to nurture them properly.

- Transformed casual browsers into qualified loan applicants through personalized guidance and educational touchpoints, increasing application quality by 45%

- Significantly boosted lending partner approval rates by delivering better-educated customers who understood their financial options and requirements

- Created multiple natural conversion opportunities throughout the customer journey, replacing the traditional all-or-nothing landing page approach

- Built lasting relationships that reduced customer acquisition costs by 60% through decreased reliance on paid channels

- Generated more predictable revenue streams through stronger brand loyalty, with 70% of customers returning for additional financial products

Educational content became our secret weapon in transforming the traditional lending funnel. Instead of immediately pushing visitors toward application forms, we created a journey that taught them how to improve credit scores, understand complex lending terms, and make more informed financial decisions. By integrating targeted SMS and email campaigns that focused on genuinely helpful content rather than promotional messaging, we built meaningful ongoing conversations with our audience. This shift from transactional marketing to relationship building wasn't just about being nice - it fundamentally changed how leads moved through our pipeline and dramatically improved the quality of applications our lending partners received.

The Results: Impact Was Immediate & Substantial

This strategic shift fundamentally transformed their business model – moving from a costly acquisition-focused approach to a more sustainable retention strategy. The numbers tell the story: customer acquisition costs dropped by 40% within the first quarter, while the 90-day retention rate increased from 12% to 35%. By building lasting relationships with their audience, they not only reduced acquisition spending but also saw the average customer lifetime value increase by 85% – proving that investing in retention pays dividends.

- Revenue nearly doubled within 6 months after launch of redesign

- Immediate boost in conversion rates & other critial metrics from day one

- More form conversions with reduced bounce & abandonment rates

- Crafting high quality users brought 28% increase in lender approvals

- Lower cost per paid acquisition & owning more of the funnel

- Higher quality leads greatly improved downstream conversion rates

"The redesign didn't just improve our metrics – it completely transformed how we connect with customers at every stage of their journey. The revenue impact exceeded our highest expectations."

Why It Worked: Three Pillars of Great UX

Data-First Design

Full-Funnel Thinking

Trust Through Transparency

The Journey Of Continuous Improvement – And Shared Resource Bonuses

The redesign wasn't the end – it was just the beginning of exploring a fresh optimization canvas. The team implemented:

- Ongoing A/B and multivariate testing programs of all depths

- Regular user behavior analysis through heat mapping and session recording

- Continuous form optimization based on submission data quality

This new design gave CreditLoan.com room to grow, providing a foundation for future optimizations that wasn't possible with the old version. It's not just a landing page – it's a conversion engine that keeps getting better.

And after verfiying how well the redesign actually worked, the formula was used as a template for a handful of sister brands that catered to a wide spectrum of different personas – further proving it's versatility and adaptability.

What Did We Learn?

- When optimization plateaus, sometimes you need to rebuild from the ground up

- Understanding the full customer journey is crucial for breaking through conversion ceilings

- Trust signals and educational content can coexist with strong conversion focus – a “soft sell” is possible

- Data should drive decisions, but sometimes you need to look at it from new angles

- Dynamic personalization transforms how users experience your content - and how your team deploys it

Remember: In paid advertising, the landing page isn't just a destination – it's the bridge between advertising promises and user needs. Build that bridge right, personalize it thoughtfully, and the results will follow.